Work on the retirement age at insurers and brokers

5 August, 2024 | Aktuell Nicht kategorisiert

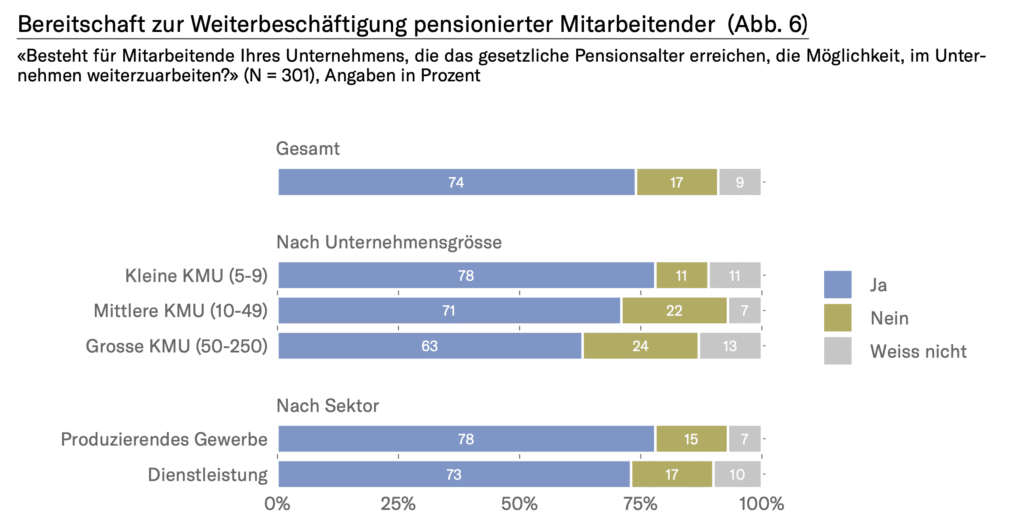

The 2023 labour market study by AXA and Sotomo shows that three quarters of SMEs are employing workers beyond the statutory retirement age in order to counter the labour shortage. In contrast to hiring older employees, companies do not incur any familiarisation costs by continuing to employ staff beyond retirement age. In addition, global expertise can be retained. thebroker asked insurance companies and brokerage firms what their situation is.

According to the Federal Statistical Office (FSO), the early retirement rate in the period 2021-2023 one year before the statutory retirement age was 39% for men (at 64 years of age) and 33.7% for women (at 63 years of age). Compared to the period 2006-2009, when it was 47.1% for men and 43.2% for women, this rate is declining. According to the 2023 labour market study by AXA and Sotomo, three quarters of SMEs are employing people beyond retirement age in order to counter the labour shortage.

From the 2023 labour market study by AXA and Sotomo.

thebroker asked various Swiss insurers and brokerage companies how they plan to continue employing staff beyond retirement age.

ASSEPRO

In principle, all employees are allowed to work beyond the age of 65 if there is a need. The employment contract ends automatically when retirement age is reached. If the employee wishes to work longer, this must be reported in good time. After a review, a decision is made as to whether and for how long the contract will be extended. The contract can be extended in any case up to the age of 70. ASSEPRO ’s regulations apply to all employees, whether part-time or full-time, before or after reaching retirement age. There are some employees who are of retirement age and continue to work for ASSEPRO. This year, just under 2% took early gradual and gradual retirement. The insurance broker always has people who take full or partial retirement.

AXA

In principle, employees are free to decide whether or not they wish to continue working after reaching regular retirement age. On the one hand, this is a private decision and, on the other, a question of the needs of the respective team. Employees are usually free to decide whether or not they wish to continue working after reaching regular retirement age. This is both a private decision and a question of the needs of the respective team. A full or reduced workload is possible, as is re-entry after early retirement.

Currently, a low double-digit number of employees continue to work at AXA beyond the normal retirement age without being actively encouraged to do so. However, the insurer knows from an internal survey that around a third of its employees can imagine continuing to work. In future, AXA will examine how its framework conditions can be adapted to this need. In future, it wants to do more to promote the continued employment of its employees so that they can benefit from their valuable experience for longer and to relieve the pressure on individual specialist areas that are more severely affected by the shortage of skilled labour. The majority of employees take early retirement. At around 62.5 years, the average age of employees at retirement is slightly above the industry average.

Allianz Suisse

There are currently 29 employees working for the insurer over the reference age of 65. Allianz Suisse expressly welcomes employees who wish to continue working beyond the age of 65. As part of its duty of care, Allianz Suisse undertakes to examine each individual case of continued employment to ensure that the employee’s interests, operational requirements and ability to work are taken into account. Allianz Suisse considers it important to be open to employees and not to impose any restrictions when it comes to continued employment. It is up to the employees to continue working. In their view, the relevant question would be how many people in the insurance industry prefer to take early retirement, but Allianz Suisse does not know this.

Baloise Group

In principle, it is possible to work after 65, but there is no entitlement to continued employment. In individual cases, continued employment may make sense for both employer and employee. On average, Baloise has around 20 employees who are over 65. In principle, there is no age limit. As a rule, however, employees are under 70, as AHV benefits can be deferred until 70 at the most. In general, all workloads are possible. However, most employees over 65 work a reduced workload. As the Baloise Group does not collect any data, it cannot make a reliable statement about the number of employees who wish to work longer. On average, around 30-35 people take early retirement each year.

CSS

The employment relationship ends when the normal AHV retirement age is reached. CSS agrees a new employment contract with employees who wish to work longer. This option is open to all CSS employees. There is no limit on continued employment. In most cases it is for a few months, in rare cases for one to two years. The respective workload is adapted to the requirements of the job and agreed jointly. A handful of people work longer each year. From 2021 to 2023, CSS counted a total of 95 retirements, 50 of which were early.

Funk Group

The Funk Group also offers the option of working longer. The broker endeavours to cater to the individual needs of employees as well as possible, while at the same time having an interest in retaining most of the many years of experience within the company for longer. Succession planning takes place at an early stage and in consultation with the employees. There are no fixed rules on how long employees may continue to work. Funk finds individual solutions and takes the employees› needs into account as much as possible. As a rule, employees request a reduced workload after reaching the normal retirement age. So far, four employees have requested continued employment. However, no one has taken early retirement.

Howden

Howden assumes that its employees want to take their well-earned retirement at 65. However, they are happy to look into continuing to work together if it makes sense for both sides. Whether with a full or reduced workload must be assessed on a case-by-case basis. In the last 2.5 years, 3 people wanted to work longer and 4 people wanted to retire earlier.

Pax

At Pax, employees can work beyond the reference age if they wish. If there is a corresponding interest, the possibilities and framework conditions for further collaboration are determined on an individual basis, taking into account the respective situation. So far, the desire to retire early has been greater than the desire to work longer.

Suva

As an attractive employer, Suva wants to give its employees the opportunity to work beyond retirement age. This opens up opportunities to retain the expertise of experienced employees at Suva for longer, thus optimising the transfer of knowledge and strengthening intergenerational cooperation. It is possible to defer the retirement pension until the age of 70, but it is also possible to continue working beyond this age. The workload for continued employment after reaching retirement age is irrelevant; you can continue to work full-time or part-time. Suva offers various retirement options that support this flexibility.

In the years 2021 – 2023, an average of 75 employees per year reached retirement age. During this period, an average of 10.8% decided to continue working beyond retirement age. 73.7% took early retirement during the same period.

SWICA

In principle, it is possible to work at SWICA beyond retirement age. However, it depends on the needs of the company, which is why Swica has no regulation and looks at the issue on a case-by-case basis. There is no fixed rule on how long you can continue to work, but SWICA takes 70 years as a guideline. After this age, it is no longer possible to pay into the AHV. There are all variations of continued work and it depends on the situation and needs. SWICA usually issues fixed-term contracts in order to maintain mutual flexibility. It is often specialists who want to work a little longer and for whom the insurer is happy if their knowledge can be transferred. Very few employees want to work longer. SWICA does not conduct targeted surveys on this. Today, only a small percentage retire early, but the trend is rising.

Swiss Life

As an employer, Swiss Life offers various working models in Switzerland so that its employees can actively shape their professional development and lifestyle at every stage of their lives – even beyond retirement age. This also includes the offer of flexible retirement models and thus the active, individual organisation of the transition from working life to a new phase of life. In addition to models for early or regular retirement or partial retirement, Swiss Life also offers the option of deferring retirement until the age of 70. Retirement then takes place. In principle, however, continued employment is still possible thereafter, but without insurance in the employee benefits scheme.

In addition to early, ordinary or deferred retirement, Swiss Life Switzerland offers the 58+ model. This is aimed at employees aged 58 and over who wish to reduce their workload in the final phase of their career or take on a role with less responsibility (e.g. handing over management responsibility) without reducing their future pension. You can use the 58+ model until you reach the normal retirement age. After consultation with the employer, continued employment beyond retirement age is possible. Employees 58+ make active use of the flexible working models on offer.

Swiss Re

Swiss Re (permanent) employees have the option of continuing to work full-time or part-time beyond the normal retirement age of 65 in accordance with the applicable regulations of the Swiss Re Pension Fund. In consultation with their line manager, employees may continue to work until the age of 70. For employment after the age of 65, the general terms and conditions of employment and all relevant additional benefits continue to apply. A change in the level of employment (full-time/part-time) with a corresponding adjustment to remuneration and benefits can be agreed at any time; this is not dependent on age.

Currently, fewer than 10 Swiss Re employees work beyond the normal retirement age of 65. This year, for the first time, a Swiss Re employee retired at the age of 70. In 2023, around 5% of eligible employees opted for early retirement before 65.

Verlingue

Continued employment beyond the normal retirement age is possible for employees under the Verlingue scheme. If there is a desire and need for continued employment, the options are discussed individually with the employee. Verlingue considers each case individually. This depends on the state of health, the employee’s needs and the person’s ability to continue supporting the company. Individual solutions are also found for the workload. A part-time workload is usually preferred. In the insurance industry, early retirement is more common than continued employment.

In the last 4 years, Verlingue has only had one person who has worked one year longer. Currently, around half of employees take early retirement. Usually 1-2 years before the normal retirement age. If earlier retirement is not desired, employees often switch to a slightly lower workload.

Zurich

In consultation with their manager, Zurich employees have the option of working beyond retirement age, either as part of a deferral or as alumni (temporary contract based on an hourly or monthly salary). Employment can continue after retirement with or without an interruption. Employees can officially continue to work until the age of 70. There are individual cases in which people continue to work for Zurich beyond the age of 70.

In the event of a postponement, Zurich usually continues employment as before. However, it is also possible for people to take partial retirement and continue working with a reduced workload as part of a deferral. If employees decide to continue working as alumni, they often reduce their workload. The number of people working beyond retirement age has increased significantly in recent years. Slightly less than half of employees decide to work longer. A minority choose the option of early retirement or retirement at retirement age.

All Swiss insurers and brokers surveyed show that the reference age of 65 is not necessarily the end of the road. Only Zurich stands out from the rest, with just over half of its employees opting to work longer. All others can continue to work until they are 70, although some insurers and brokers also employ staff beyond this age. The majority of employees are still taking early retirement.

The number of people who postpone retirement by at least one year, but no more than five years, will increase. Women in particular will be able to increase their pension for life. As pensioners make up an increasingly large proportion of the population and fewer young people are coming into the workforce, various forecasts predict that there will be a shortage of half a million workers in the Swiss labour market by 2030. Employers are therefore likely to make it attractive for their 65-year-olds to continue working with various offers, because 70 is the new 50.

BK

Read also: Holy cow retirement age 65: How much do people work in other countries?