Ledgertech: Is embedded insurance the future?

7 April, 2025 | Aktuell Interviews Nicht kategorisiert

Ledgertech, a digital insurance technology company, was founded in 2019. Its goal is to drive digitalisation and automation in the insurance industry, using new technologies such as low code/no code, AI and machine learning. The two founders, Eran Tirer and Omer Caspi, have already created EZSource, which was acquired by IBM in 2016. EZSource’s product (now IBM ADDI) enable insurance companies and banks to analyse and solve complex challenges related to legacy systems.

The Ledgertech platform is a low code/now code core digital insurance platform that significantly shortens time to market of new insurance products with advanced consumption model and differentiated products.

thebrokernews talks to Eran Tirer, co-founder and CEO of Ledgertech, winner of The Digital Insurer’s EMEA and Global InsurTech Innovation Awards 2024 and the InsurTech of the Year 2024 Award at the Swiss InsurTech Hub Summit and Awards.

2024 has been a good year for Ledgertech. You have won two awards. Which one made you happier?

Eran Tirer: 2024 has truly been a milestone year for us. We were honored to receive The Digital Insurer’s Insurtech Innovation Award for both EMEA and Global, a strong validation of our technology and impact on the international stage. We were also proud to be recognized as Swiss Insurtech of the Year in the Embedded Insurance category, which reflected our growing presence in the European ecosystem. And to top it off, being included in CNBC’s list of the World’s Top 150 Insurtech Companies gave us further encouragement that we’re building something meaningful.

Each recognition highlights a different aspect of what we’re doing—global innovation, embedded excellence, and industry leadership—and together, they’ve energized our team to keep pushing forward.

Also last year, you entered into a partnership with eazy.insure, the first fully digitalised insurer in Romania. How did this collaboration come about?

We were introduced to eazy.insure through mutual industry connections. What stood out immediately was the alignment in vision—they were looking for a technology partner to help build a modern, fully digital insurance experience, and we had the tools to make it happen. From our first discussions, it was clear they wanted a partner that could move fast, offer embedded capabilities, and provide robust automation. The collaboration quickly turned into a joint success, launching Romania’s first embedded digital insurance platform.

In 2016, you sold your company EZSource, which provided core platforms analysis and understanding solutions for insurance companies and banks, to IBM. You could have had a nice life with the money. So why did you found Ledgertech together with Omer Caspi?

The sale of EZSource was a major milestone – not just a successful exit, but a strong validation of the technology we built and the team behind it. Being acquired by one of the world’s most respected tech giants affirmed our ability to develop enterprise-grade solutions that scale and deliver real, measurable value.

But after the acquisition, Omer and I knew the journey wasn’t over. Some of our clients at EZSource came from the insurance sector, and we had a front-row seat to the limitations they were facing. Legacy systems, siloed architectures, and manual processes were holding insurers back from the digital transformation the industry urgently needed. That observation led to the founding of Ledgertech.

Our vision was to build a platform that combined modern tech infrastructure, easy integration (or full core system replacement) to deliver full automation and embedded insurance capabilities in one cohesive solution. This wasn’t about launching another company—it was about solving a critical industry problem in a way that hadn’t been done before.

At a breakfast event hosted by the Swiss InsurTech Hub (SIH) on the topic of embedded insurance, you identified digitalisation as one of the biggest problems facing insurance companies. Why is that?

Many insurers are still operating on legacy core systems that were never designed for today’s fast-moving digital world. These systems are rigid, complex, and difficult to integrate with modern tools or customer-facing channels. As a result, something as basic as launching a new insurance product can take 9 to 18 months – involving multiple teams, custom development, and manual processes just to get to market.

This lack of agility doesn’t just affect insurers internally – it directly impacts the customer experience. Today’s policyholders expect digital-first, personalized, and instant services. When insurers are slow to adapt, they struggle to meet these expectations. Quoting takes too long, onboarding is clunky, and claims processes are far from seamless. That creates friction, reduces conversion rates, and ultimately drives customers toward more agile, tech-enabled competitors.

So, digitalization isn’t just about having a portal or an app – it’s about transforming how fast and efficiently insurers can react to market changes, launch new products, and serve customers. And that’s exactly where most traditional systems fall short.

At Ledgertech, we focus on solving this by giving insurers a platform that delivers true speed and flexibility – whether they want to integrate with existing core systems or replace them entirely. The result is faster time to market, lower operational costs, and a dramatically improved customer experience.

What do you do when a customer’s core system is outdated?

One of the strengths of Ledgertech’s platform is its flexibility. We recognize that no two insurers are starting from the same point – some operate with complex legacy infrastructures they need to retain, while others are ready to make a full leap toward digital transformation.

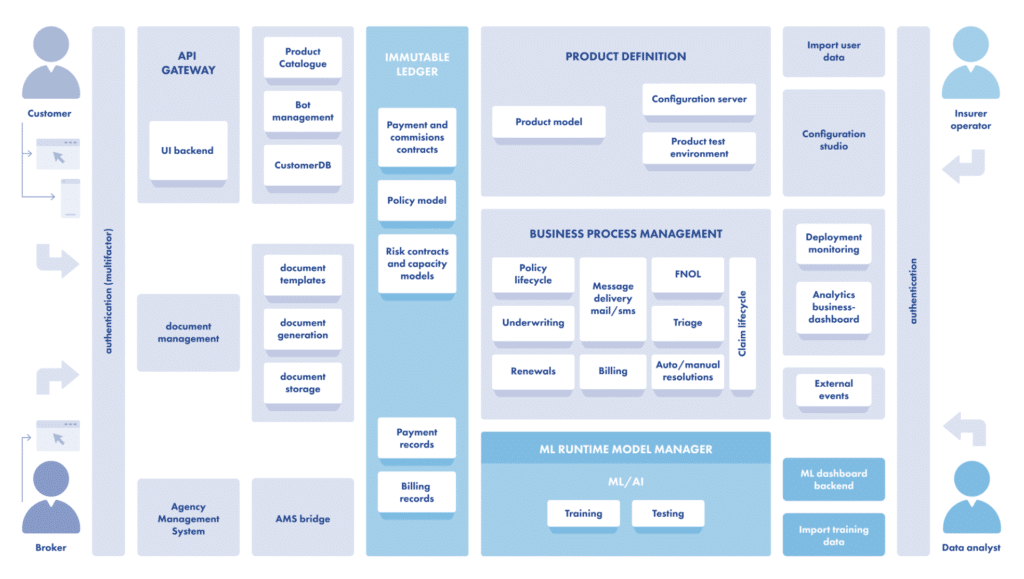

Our platform is cloud-native, modular, and API-first, enabling us to seamlessly integrate on top of existing core systems. In this role, Ledgertech acts as a powerful embedded insurance enabler, managing the full policy lifecycle, automating operations, and connecting to distribution partners – without requiring a core replacement.

At the same time, for insurers looking to replace their legacy systems entirely, our platform is robust enough to serve as a full core system replacement. It supports everything from product configuration to policy administration and reporting – all with built-in automation and speed.

What makes our solution unique is that it doesn’t have to be all or nothing. We give insurers the flexibility to start by extending their capabilities—and, if needed, scale into a full core replacement over time. It’s transformation on their terms, with measurable impact from day one.

Why do you think embedded insurance represents a great opportunity?

Embedded insurance isn’t just a trend—it’s a response to how people live and buy today. Instead of expecting customers to seek out insurance, we meet them in the digital moments that matter – booking a trip, buying a phone, starting a job, or completing a checkout.

This model transforms insurance from a standalone purchase into a frictionless, contextual experience. For insurers, it means lower acquisition costs, higher conversion rates, and access to underserved or previously unreachable customer segments.

But to unlock this opportunity at scale, insurers need the right infrastructure: flexible, fast, and designed for integration. That’s where Ledgertech comes in. We enable insurers to embed insurance into everyday digital journeys—within telecom, fintech, e-commerce, employee benefits, and beyond—making protection more relevant, accessible, and scalable.

In a world of constant digital interaction, embedded insurance delivers a simple promise: be present, be timely, and be useful.

What technology is needed for this?

Delivering embedded insurance at scale requires a platform that’s as agile as the ecosystems it plugs into.

At Ledgertech, that means a cloud-native, API-driven architecture with full automation and deep integration capabilities. We use Docker and Kubernetes to ensure scalability and high availability across global deployments. Our low-code/no-code configuration studio empowers business users to launch and adapt products in weeks, not months—without relying heavily on IT resources.

Because embedded insurance must adapt to real-time customer behavior, we’ve also built in robust real-time data handling, localization support, and a Business Process Management (BPM) engine that tailors’ operations to each product’s unique flow.

In short, the technology behind embedded insurance needs to be flexible, automated, and ecosystem-ready—which is exactly how we’ve built Ledgertech from the ground up.

You talk about a market potential of $700 billion for embedded insurance. How did you arrive at this figure and what areas of application do you mean?

The $700 billion figure is based on a 2024 report from Research and Markets, which projects that the embedded insurance market will grow to more than USD 703 billion by 2029, reflecting a compound annual growth rate of over 35%. This aligns with broader industry analysis from firms like Deloitte and Bain, which point to embedded insurance as one of the most transformative trends in the sector.

This market potential comes from the fact that embedded insurance changes not just how insurance is distributed, but where and when it’s offered. By integrating coverage into existing digital journeys, insurers can offer protection at the exact moment it’s relevant – making it more accessible, more contextual, and more likely to be adopted by the customer.

We’re already seeing strong traction in areas like travel insurance – particularly usage-based and pay-as-you-go models – along with device protection, cyber insurance, and even health coverage embedded into employee benefit platforms. But the opportunity goes far beyond that. At Ledgertech, we’ve also supported embedded solutions for SMBs, parking insurance, and other industry-specific use cases where traditional distribution simply doesn’t fit the customer journey.

The beauty of embedded insurance is its adaptability. It’s not limited to a single line of business or channel – it’s about meeting customers where they are, in ways that feel natural and effortless. And with the right technology in place, that becomes entirely achievable.

Insurance brokers no longer play a role in embedded insurance. Why do we still need them?

We believe brokers still play an essential role, especially in complex lines and business insurance. What’s changing is how they engage. Brokers who adapt—by leveraging platforms like ours to offer embedded options or personalized digital journeys—can remain highly relevant. It’s not about replacement, it’s about evolution.

What are the reasons why you expect us to see a major shift towards embedded insurance?

The shift is driven by changing consumer behavior and digital distribution models. People expect services to seamless, easy and instant – insurance is no exception. Meanwhile, non-insurance players (like telcos, digital banks or e-commerce) are looking to add value and unlock new revenue. Embedded insurance answers both needs.

How much can embedded insurance accelerate growth in the market?

Embedded insurance has the potential to significantly grow the overall insurance market, not just shift existing business from one channel to another. By integrating insurance into digital customer journeys—such as booking a flight, purchasing a smartphone, or onboarding to a freelance platform—insurers can reach customers who wouldn’t otherwise seek out or purchase coverage.

According to EY, more than 30% of global insurance distribution could shift to embedded channels within the next 5 years, driven by digital platforms and ecosystems. What’s especially powerful is that embedded insurance enables access to entirely new customer segments, particularly in markets that are underinsured or overlooked by traditional distribution models.

Additionally, Munich Re estimates that embedded insurance could account for more than USD 500 billion in P&C premiums by 2030, and much of this will be net new business enabled by real-time, contextual distribution—something traditional channels struggle to deliver.

In short, embedded insurance doesn’t just make insurance more accessible—it grows the pie by removing friction, enhancing relevance, and expanding reach. For insurers that adopt the model early, the opportunity isn’t just faster growth—it’s broader market penetration and a stronger connection to today’s digital-first customer.

It usually takes 9-18 months to develop and distribute new insurance products. What problems does the Ledgertech platform solve for its customers?

Time to market is one of the most common pain points we hear from insurers—and one of the most critical problems Ledgertech is designed to solve.

Traditional insurance systems often come with long development cycles, complex integrations, high operational costs, and limited digital reach. Launching a new product can take over a year. On top of that, many insurers face challenges when trying to integrate new solutions with their legacy systems.

Ledgertech addresses this by offering a cloud-native, low-code/no-code platform specifically built for agility, speed, and seamless integration. Our product configuration studio allows insurers to launch new insurance products in just 4–6 weeks, not 9–18 months. Business and product teams can design, test, and deploy without writing code, dramatically reducing dependency on IT and accelerating go-to-market timelines.

But speed is just the beginning. The platform also integrates easily with existing core systems and third-party providers through an API-based structure, eliminating the need for costly overhauls.

Importantly, Ledgertech empowers insurers to offer modern, personalized insurance models (UBI, PAYG, PHYG, etc), that are increasingly relevant in today’s digital-first world, allowing insurers to tailor offerings to actual customer behaviors – something that legacy platforms weren’t built to support. Combined with real-time data insights, this enables smarter decision-making and faster iteration.

Even better, Ledgertech also unlocks the ability to offer cost-effective microinsurance products—which would typically be unprofitable to launch on legacy infrastructure due to high development costs compared to the relatively low GWP per policy they generate.

Through our global distribution network, we help insurers meet customers directly within their digital journeys right when and where it matters most.

In short, Ledgertech solves the two most important challenges insurers face today: how to move fast, scale smart and stay relevant.

What do you need to pay particular attention to when manufacturing a product?

One of the most critical factors in product development is ensuring the insurance offering fits the customer moment—not just the insurer’s intention. In other words, contextual relevance is key. Embedded insurance works best when the offer is timely, simple, and clearly valuable to the customer. That means designing products that align with real-life triggers—like booking a trip, buying a device, or signing up for a service—rather than offering generic, one-size-fits-all coverage.

Customers don’t wake up thinking about insurance—and they rarely seek it out proactively. They buy it when it feels natural. That’s why successful product design demands a deep understanding of when, where, and how the product will be offered.

This connects directly to another essential principle: start with distribution, not just coverage. Who will be offering the product, in what context, to what kind of customer? What does their customer journey look like? What value does the insurance add to their core offering?

Even a perfectly designed insurance product can fail if it doesn’t align with the digital journey or commercial incentives of the distribution partner. Distribution-first thinking ensures the product integrates seamlessly into the customer experience, delivers real value to the partner, and—most importantly—gets used.

Which products really strengthen the sales channel?

Products that align with the context of the distribution partner. For example, travel insurance offered through mobile operators or eSIM providers, device protection embedded with electronics retailers, health and life insurance via employee benefit platforms, or cyber insurance tailored for SMB platforms. These products feel natural rather than forced—which is exactly why they convert well. They enhance the core offering of the partner while delivering real value to the customer, creating a win-win for all sides involved.

To illustrate an embedded insurance use case, I would like to ask you to present your development of an annual travel insurance product to our readers.

One of our standout innovations is an automated Pay-As-You-Go (PAYG) travel insurance product, designed specifically for embedded distribution. The idea is simple but powerful: the insurance automatically activates only when the customer is abroad, using telecom data or geolocation, and deactivates upon their return. The customer pays only for the days they’re actually traveling, and everything—from activation to claims—is fully automated.

We’ve embedded this product with eSIM providers and mobile operators, making it a seamless part of the travel experience. There’s no need to fill out forms, calculate trip dates, or remember to enable coverage. It’s insurance that works quietly in the background—timely, relevant, and effortless.

This model delivers clear value to all parties involved:

- For the customer, it offers convenience, transparency, and fairness. They get real-time protection when they need it, without the hassle or cost of unused coverage.

- For the insurer, it opens a high-conversion, low-cost distribution channel, supported by rich behavioral data and usage-based pricing insights.

- For the distribution partner, it strengthens their offering with a relevant, value-added service, improves customer satisfaction, and creates a new revenue stream with minimal operational effort.

This product is a great example of how embedded insurance, when done right, goes beyond selling coverage—it adds meaningful value across the entire ecosystem, exactly when and where it’s needed most.

Read also: The Transformative Power of Embedded Insurance in the Age of AI

Suche:

Sponsoren:

Kategorien

- Aktuell (1'209)

- Allgemein (302)

- Blog (45)

- Firmenporträts (27)

- Gastbeiträge (23)

- Interviews (187)

- Nicht kategorisiert (1)

- Podcasts (7)

- Termine (4)

- Video (10)