‘Long and healthy life’: Interview with Dr Yael Benvenisti

9 Dezember, 2024 | Aktuell Interviews Nicht kategorisiert

A recent British study in the Journal of “Neurology Neurosurgery & Psychiatry’”shows that men’s health declines from the age of 55 onwards. The factors that lead to this include obesity and diabetes, which increase the risk of cardiovascular disease and affect the brain. The study thus shows that men are at risk much earlier than women, which has important implications for prevention. On the other hand, global life expectancy has increased by five years since 1990 and continues to rise.

thebroker talks to Dr Yael Benvenisti, about the ageing population and its impact on the insurance industry. She joined InsurTech Israel as Deputy CEO just four months ago and is an expert in the field of gerontology.

Let’s start with the opposite of old: the average birth rate in Switzerland in 2023 was 1.33 children (-2.8% from the previous year), in Germany 1.36 (-6.2%). In all EU member states, the birth rate in 2022 was well below 2.1 children, which is the number that would have to be born per woman to keep a country’s population from shrinking. That’s worrying, isn’t it?

Yes, these numbers are indeed concerning. A fertility rate of 2.1 children per woman is considered the «replacement level,» where the population remains stable without relying on immigration. Rates significantly below this level, as observed in Switzerland, Germany, and across the EU, indicate potential challenges:

- With fewer children being born, the population ages. This creates a demographic imbalance where fewer workers are available to support a growing retired population. Pension systems and healthcare services come under strain, potentially leading to economic instability.

- A shrinking workforce can slow economic growth, reduce innovation, and create labor shortages in key sectors

- While immigration can help address labor shortages, it requires effective integration policies and societal acceptance, which are often politically sensitive.

The Aging population is profoundly impacting the insurance industry, and I would like to give some examples:

- Lower Need for Life Insurance: Fewer births and smaller families mean less demand for life insurance as there are fewer dependents relying on financial support.

- Elderly-Focused Products: As populations age, there’s increased demand for products like long-term care insurance (or special long-term care saving plans), chronic disease management plans, annuities, and other retirement-related policies.

- Increased Claims: Older populations lead to higher healthcare usage, creating higher claims for health insurance providers

- Longer Payout Periods: With rising life expectancy and fewer workers contributing to pension systems, annuity products face financial strain. Insurers must carefully assess longevity risks to maintain profitability

- Customizable Retirement Plans: There’s growing interest in flexible products that allow policyholders to adjust their plans as needs change with age

- Declining Home Ownership: Low birth rates and aging populations may slow housing markets, affecting demand for homeowner insurance

My last advice to insurers: As birth rates and populations decline in developed nations, insurers may find growth opportunities in developing countries with younger demographics and expanding middle classes.

In Israel, on the other hand, the birth rate is 3 children. This means that Israel’s population is growing while Europe’s is shrinking. Which is better?

Israel’s birth rate of 3 children per woman is significantly above the replacement level, however, there are notable challenges- While the elderly population is increasing at a slower rate than in Europe, it still represents a challenge for healthcare, pensions, and long-term care systems. Another important issue is that not all segments of Israel’s population contribute equally to the economy. For example, lower workforce participation in certain communities, such as parts of the ultra-Orthodox and Arab populations, impacts overall economic productivity. This imbalance creates additional strain on the working population and public resources.

In my opinion, neither is inherently «better»; it depends on how each country addresses its challenges

The above study shows that men with a high risk of cardiovascular disease are affected by cognitive decline about ten years earlier than women. These are not encouraging figures, and show that prevention should be taken much more seriously. But how?

Taking prevention seriously in the context of rising consumption of health services requires a multifaceted approach that addresses individual behavior, community engagement, healthcare systems, business stakeholders, and policy measures. Insurance companies can play a pivotal role in promoting prevention. For example:

- Discounted Premiums/ Reward Programs: Offer lower premiums to customers who demonstrate healthy lifestyles, such as regular exercise, healthy BMI, or non-smoking status

- Comprehensive Coverage: Ensure policies include coverage for preventive care, such as screenings, vaccinations, mental health counseling, behavioral change (such as personalized coaching) and wellness programs

- Predictive Analytics: Use data to identify policyholders at higher risk of certain conditions and proactively offer interventions, such as personalized health plans or consultations

- Prevention-Centric Plans: Create insurance plans specifically focused on prevention, where the majority of benefits are tied to wellness and early intervention

To what extent will research into longevity revolutionise the insurance industry (life insurers, health insurers)?

It has a potential to revolutionize the insurance industry but it will take time because it is very complex and there are many factors involved (biological age prediction and monitoring, mental health, development of precision medicine, molecular generation, protein design, external environment including climate change and many more). The primary goal of longevity research is to postpone the onset of age-related diseases, thereby improving quality of life. While this would undoubtedly extend the period for which life insurance coverage is needed, it’s unlikely to significantly impact the overall demand for health insurance. Instead, there’s likely to be a growing need for services focused on early disease detection and prevention.

A growing population of older people is putting a strain on our social security systems, healthcare and pension funds. What are the most important measures and how much time do we have to implement them?

To mitigate these issues, several key measures must be implemented (not all of them can be done by insurance companies) like raising retirement age or creating flexible retirement options. Immediate action is crucial to address the long-term consequences of an aging population.

Many of these measures require significant policy changes and societal adjustments, which may take several years to fully implement.

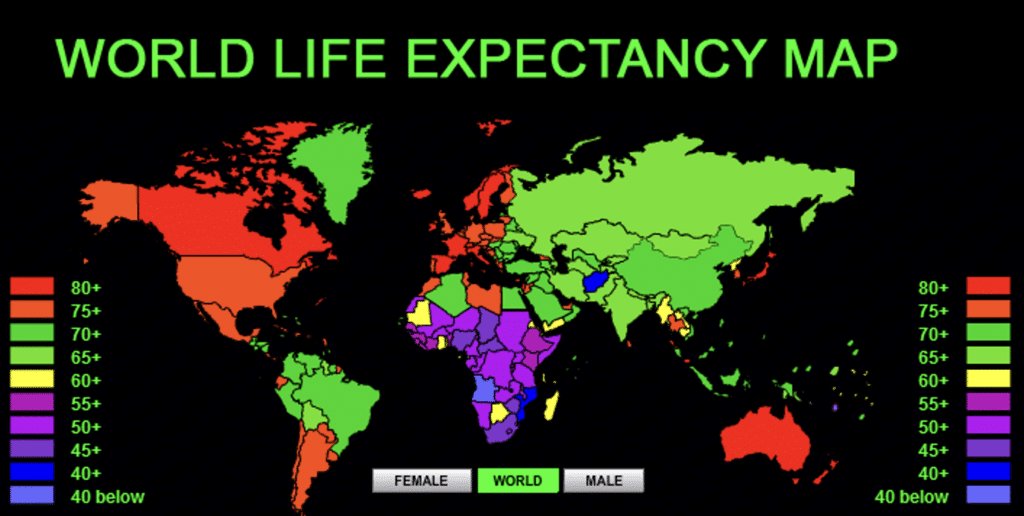

Here is the link to the animated life expectancy map.

Prevention is key, but the words weight loss, exercise, healthy eating and medication to improve insulin sensitivity are not appealing to many people. What do you think of drugs like SGLT2 inhibitors and GLP-1 analogues like semaglutide, which are initially used to treat type 2 diabetes and are now also used to treat obesity?

While drugs like SGLT2 inhibitors and GLP-1 receptor agonists have demonstrated significant efficacy in managing obesity and improving metabolic health, they are not a standalone solution. While these medications can be a valuable tool in a comprehensive weight management strategy, it’s crucial to recognize their limitations and the importance of a holistic approach. First, like any medication, these drugs can have side effects, which may vary from person to person. Second, many individuals reported on weight regain after discontinuing medication, highlighting the importance of long-term lifestyle changes. Third, relying solely on medication to address health issues can lead to neglecting fundamental lifestyle factors such as diet, exercise, and stress management – obesity is not the only factor influencing ones health…..

The so-called ‘weight-loss injections’ can also help to prevent cognitive deterioration and are covered by most health insurance providers. Shouldn’t many more people be treated with them?

As mentioned earlier, it’s dangerous to think that a single drug can solve all problems. Research on the effects of these drugs on cognition is still in its early stages, and I would hesitate to recommend their widespread use. Of course, this is not an insurance company decision but a public health one. Additionally, cognitive decline can have various causes, such as sodium deficiency, drug interactions, neurological diseases, or even brain tumors. Each case must be evaluated individually. At this stage, I would focus on promoting a healthy lifestyle.

Health insurers need a lot of data to be able to make their customers better offers. The general practitioners would also have to assess each person for weight (abdominal fat), nutrition, lifestyle, sleep, fitness, stress management, etc. and share this data with the insurers. Don’t you see problems in the fact that insured persons do not want to share this data?

You’ve raised a critical point about the tension between data privacy and personalized services. Many individuals are hesitant to share sensitive personal data, fearing potential misuse or discrimination.

To address these concerns, several strategies can be employed:

- Transparent Data Practices: Insurers should be transparent about how they collect, use, and protect personal data. Clear and concise privacy policies can help build trust.

- Allow individuals to control what data they share and for what purposes for example insurers can offer wearables or mobile apps that collect health data directly from users. These tools can empower individuals to decide which data to share and can incentivize participation with rewards or discounts

In addition, in my opinion insurers must establish third-party oversight committees to monitor how data is used by insurers to ensure ethical practices.

Currently, health insurers offer various modules with alternative insurance models in the basic insurance, such as free choice of doctor, family doctor model, HMO model, Telmed model, etc. There are also various fitness apps or prevention contributions from supplementary insurance to cover the costs of an annual fitness subscription, etc. Wouldn’t it be much better if these offers were standardised and applied to all insurers?

Standardizing certain health benefits could ensure equity and potentially improve public health outcomes, but such changes are likely to occur naturally through market competition rather than regulation. We, as a society, do not want insurers to lose the incentive to innovate, as competition drives the development of creative products. More importantly, consumers could miss out on tailored solutions that meet their specific needs.

Additionally, establishing a standardized framework across all insurers would be legally and logistically challenging, especially in systems with both public and private providers. Health systems and populations differ across regions, making a one-size-fits-all approach ineffective.

Instead of standardizing a fixed package of benefits, it may be sufficient to require all insurers to offer at least one fitness program or prevention initiative. This balanced approach could promote equity while preserving innovation and flexibility

According to the ‘Sanitas Health Forecast 2024’, more than half of the people would be willing to make radical changes to live a long and healthy life. This sounds easy, but when it comes to weight loss or regular exercise, it’s more like: started a diet and exercise program on 2 January, stopped again 2-3 months later at the latest. How could this be changed?

Sustaining long-term behavior change is a complex process that requires addressing psychological, social, and environmental factors. It’s not a one-time decision, but rather an ongoing journey. Most people need consistent support, such as coaching and personalized feedback, to maintain these changes. In today’s digital age, virtual coaching offers a convenient and effective way to overcome barriers to behavior change. By providing personalized ongoing feedback and tailored messages, virtual coaches can help individuals develop the skills and strategies needed for long-term success

By analysing disease trends, advances in healthcare and lifestyle factors, longevity research helps insurance companies to make more accurate predictions about future life expectancy. This information enables better product pricing and helps to manage risks more effectively. Will health insurance companies go down this route in the future?

While this approach has clear benefits, its application is currently more feasible in life insurance than in health insurance, and I would explain why. Life insurance deals with a binary outcome: whether the insured person lives or dies within the policy term. This makes actuarial modeling relatively straightforward. Health insurance covers ongoing, unpredictable, and complex events like chronic diseases, acute illnesses, and accidents.

Predicting such events with longevity models is far more challenging. Health outcomes depend on a multitude of factors, including genetics, environment, lifestyle, access to healthcare, and emerging medical technologies. Advances in treatments, drugs, and diagnostic tools can drastically alter health outcomes, making it hard to develop stable models. Therefore, unlike life insurance, health insurance involves underwriting not only for the risk of future claims but also for variations in healthcare costs, which are harder to predict. Since longevity research is still evolving, its application to health insurance requires robust validation to ensure accuracy and reliability. Many insurers are cautious about adopting untested methods that might lead to pricing errors, adverse selection, or customer dissatisfaction.

Advances in genetics and biomarkers could enable a more personalised approach to risk assessment and tailored insurance products that take into account individual factors and that influence life expectancy. That sounds good, but not everyone is genetically well endowed and inequalities arise. How should this problem be addressed?

It’s important to recognize that genetics is only one factor influencing life expectancy. Environmental, lifestyle, and social determinants—such as diet, exercise, stress, and access to healthcare—play equally significant roles. Moreover, within genetics itself, epigenetic factors come into play. These are external influences, like lifestyle or environmental exposures, that can activate or suppress certain genes. Epigenetic changes can alter the biological age and health of different organs, further complicating the link between genetics and life expectancy. In my opinion, more data and research are needed before these insights can be effectively applied to insurance products. The initial and most impactful applications of genetic and biomarker advancements will likely be in personalized medicine—developing tailored drugs and treatments to improve health outcomes.

Most people are horrified at the thought of further regulation. Nevertheless, what would need to be regulated?

The tension between regulation and innovation is a persistent challenge, particularly in fields like insurance, where advances in technology and data analytics are reshaping the industry. On one hand, innovation thrives in environments with minimal restrictions, enabling companies to develop cutting-edge products and services. On the other hand, regulation is essential to ensure fairness, transparency, and the ethical use of sensitive data. In the context of insurance, regulating how and for what personal data is used is paramount. Insurers increasingly rely on advanced algorithms and vast datasets. Without clear guidelines, this could lead to discriminatory practices, privacy breaches, and a loss of public trust. Additionally, each insurance company should have a dedicated committee to oversee algorithms. These committees would evaluate the fairness and accuracy of algorithms, ensure decisions made by AI systems align with ethical standards, and provide explanations for decisions to affected individuals.

Dr. Yael Benvenisti, Deputy CEO of Insurtech Israel. Former CEO of Mediterranean Towers Ventures . Dr. Benvenisti is a leading figure in the Israeli longevity ecosystem and an international speaker.

Read as well: Exploding healthcare costs: What can and must Switzerland afford?